Login scams are back in full flight, and it seems as though everyone is after your money. How do you ensure you won’t get caught?

The middle of the year means tax time is back, and while we see internet scams all year round, they seem to be especially common around now. Perhaps it’s because we’re expecting our banks and tax governing institutions to contact us, or maybe it’s just easier to fool us when money is involved.

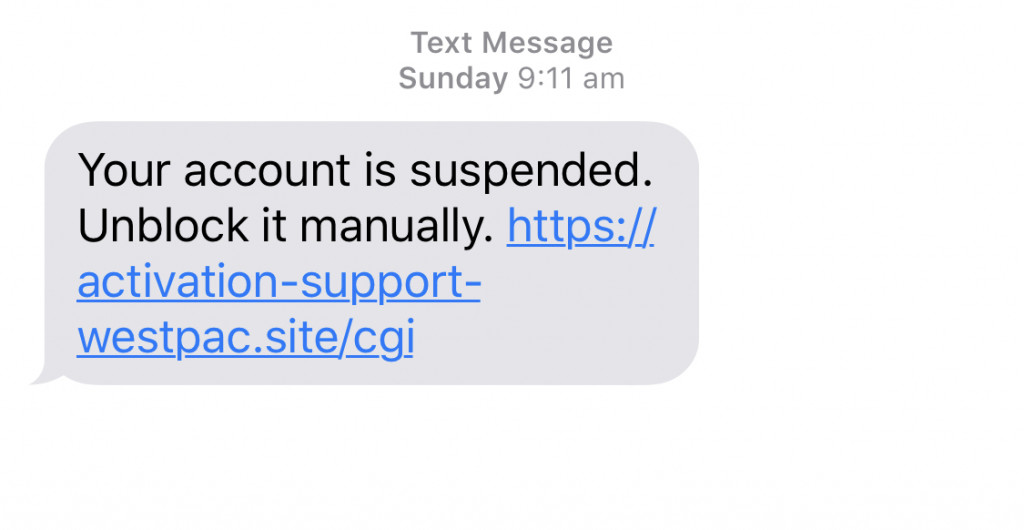

Whatever it is, we’re seeing quite a few SMS-based phishing scams, and unsurprisingly, they all seem to be aimed at ridding you of your hard earned cash.

Most of the scams that have come our way have included URLs to sites that might seem convincing, but are anything but. Many appear to come from banks, but the websites they link to are very, very much fake.

Take a text message that reportedly has a bank account blocked, asking us to go to NAB’s so-called website that reads as “nabibs-online”. Yes, it has “NAB” in the url, but little else about the link makes sense, giving you the knowledge that it is very much fake.

Some are a little more convincing, with a fake Westpac link arriving as “activation-support-westpac.site”. We say “a little more convincing” because its link is easy to look past if you don’t pay attention, however Westpac’s actual site is westpac.com.au, not westpac.site.

Slightly different from standard SMS scams, these URL-based scams are sent over SMS with little information, attempting to convince you of their truthfulness by providing a link. That can make it a little difficult to work out whether they’re real or not, but you still have one really obvious way to discern: call your bank.

If you’re at all concerned that a message you’ve received isn’t real, call the bank or institution you’ve “received the message from” to find out whether it is in fact real. Most organisations will be quick to tell you it’s fake, affirming any suspicions you may have, and giving you yet another reason to ignore it.

Ultimately, any messages that come from your bank will come from an SMS you may already know, but if you’re unsure, call. It’s always the safest option.